Who can apply for the Virgin Money Balance Transfer Credit Card

How to Apply for the Virgin Money Balance Transfer Credit Card – To apply for the Virgin Money Balance Transfer Credit Card, you must be a UK resident, at least 18 years old, and meet credit approval criteria based on your financial history. Virgin Money checks your income, existing debt obligations, and how reliably you’ve managed credit in the past.

If approved, your credit limit is based on that information—but if you’ve used the eligibility checker, you may already know your guaranteed limit. Keep reading to learn how to apply for the Virgin Money Balance Transfer Credit Card!

You also need to complete any balance transfer or money transfer within 60 days of account opening to qualify for the promotional rates. This is a great option for those who want to reduce interest costs while keeping spending disciplined.

Required documentation

Before you apply, make sure you have everything ready to ensure a smooth experience. You’ll need a valid UK-issued form of ID, such as a passport or driver’s license, and proof of your home address—ideally a utility bill or bank statement from the last three months.

The application will ask for your income details, including your employer’s name or, if self-employed, recent tax return information or bank statements. You’ll be asked about existing debts, monthly expenses, and your housing costs.

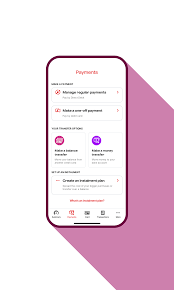

If you’re planning to make a balance transfer, you’ll also need the account number and amount from your old credit card or store card. Be prepared to verify your identity with a mobile number and email address, as all communication and card management is app-based.

A tip for you!

To fully take advantage of the Virgin Money Balance Transfer Card, timing is critical. Be sure to transfer your balance within 60 days of account opening—this locks in the 0% promotional rate, potentially for up to 32 months. Set reminders for yourself so you don’t miss this window.

Also, take advantage of the money transfer feature during the first 60 days if you need to move funds into your current account to cover bills or expenses—just remember that fees may apply. The 0% purchase window only lasts three months, so try to consolidate any big-ticket spending during that period. Keep reading to learn how to apply for the Virgin Money Balance Transfer Credit Card!

Always make your minimum payment on time to avoid losing your promotional rate retroactively. Use the app to stay updated on due dates, transfer statuses, and how long your offers will last.

How to Apply for the Virgin Money Balance Transfer Credit Card?

How to Apply for the Virgin Money Balance Transfer Credit Card – Click the button below to apply for the Virgin Money Balance Transfer Credit Card. First, use the eligibility checker—it only takes minutes and won’t affect your credit score. Once pre-approved, you’ll see your credit limit and can begin the official application.